One of the key points mentioned during GOQii’s annual event in December last year was that our current healthcare systems focus more on ‘sick care’ rather than preventive healthcare. Measures taken to ensure good health are often reactive as compared to proactive. The problem with this approach is that any precautions we take concerning health won’t be in place until it is too late.

One of the key points mentioned during GOQii’s annual event in December last year was that our current healthcare systems focus more on ‘sick care’ rather than preventive healthcare. Measures taken to ensure good health are often reactive as compared to proactive. The problem with this approach is that any precautions we take concerning health won’t be in place until it is too late.

We couldn’t stress more on why this mindset of ‘sick care’ is unyielding as opposed to leading a healthy lifestyle from the start. But as the case with most diseases and unpredictability of unfavorable circumstances, you can never be too prepared. With high healthcare costs and the trust in the healthcare systems decreasing, health insurance is certainly the need of the hour.

Universal Health Coverage

Everybody everywhere is entitled to health coverage that does not harm or put their finances at risk. Based on the WHO constitution of 1948, which declared health a fundamental human right and on the Health for All agenda set by the Alma Ata declaration in 1978, this year’s WHO theme for World Health Day is Universal Health Coverage. It is to ensure better health and protection for the poorest of the poor.

India and Universal Health Coverage

In India, approximately 62% deaths among men and 52% among women, occur due to non-communicable diseases. Due to the low utilization of the public health system, lack of effective management, awareness, and fragmentation of the healthcare services, families are forced to incur high expenditures leading to impoverishment and poverty on account of medical and hospitalization expenses. (source: https://www.pmjay.gov.in)

In an attempt to fulfill the vision of Health for All and Universal Health Coverage, the government conceived Ayushman Bharat, an initiative led by our Prime Minister Narendra Modi. Ayushman Bharat encompasses two complementary schemes, Health and Wellness Centers and National Health Protection Scheme. The Protection Scheme is envisaged to provide financial risk protection of Rs 5 lakh per family, per year to poor and vulnerable families arising out of primary and tertiary care hospitalization.

How GOQii Can Help

GOQii has always believed in enabling individuals to move from a reactive healthcare pattern to a more proactive one. The only way to achieve this is by rewarding good health. By using the data we collect, insurance companies lessen or alter the premiums paid for the life/health insurance they offer to their users, thereby cutting the cost for healthier users and altering the same for higher risk users. This helps the insurance companies and insurance holders make an informed choice of dealing with their health risks.

Through our partnership with Max Bupa, we offer a holistic health insurance offering called –‘Max Bupa GoActive’ to fulfil our customers’ daily health needs. GoActive is a digitally enabled health insurance plan that has been designed to give customers a 360-degree coverage including in-patient hospitalization and on-the-go access to OPD, diagnostics, personalized health coaching, second medical opinion, behavioral counseling and much more. The plan offers up to 20 per cent premium discount on achieving predetermined health scores and also offers benefits such as renewal discount of up to 20 per cent post achieving their health goals. We have also partnered with Swiss Re to provide underwriting assistance to Max Bupa wherein Swiss Re uses GOQii’s data to create relevant products and also build expertise to create risk assessment models for future.

In simple terms, get healthier, improve your health score and pay less premiums on your insurance cover.

To ensure good health and wellness, GOQii has organized a World Health Day Super Sale on the GOQii Health Store. Get amazing discounts on healthy products curated by our experts by using your GOQii Cash. Download the app now to avail its many benefits for free: www.goqii.com/app

#BeTheForce

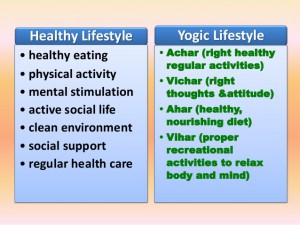

Recently, I had published a blog on how certain yoga asana, if followed with some attitude, can tune your behaviour and imbibe good qualities in you. If you have not read that blog here is the link to the same

Recently, I had published a blog on how certain yoga asana, if followed with some attitude, can tune your behaviour and imbibe good qualities in you. If you have not read that blog here is the link to the same