In the vibrant tapestry of India, where the pursuit of longevity and preventive health is increasingly paramount, GOQii is emerging as a vanguard, revolutionising the realm of health insurance and personalised medicine. This is a story not just of insurance, but of a profound shift towards a future where health care is custom-tailored, proactive, and deeply intertwined with the joys of living a long, healthy life.

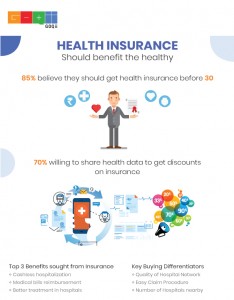

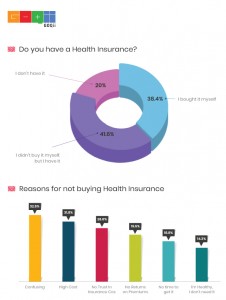

The narrative of health insurance in India is however fraught with concern. A staggering 80% of the vibrant mosaic of people, from the verdant villages to the bustling cities, find themselves without the security blanket of health insurance, leaving them vulnerable to the chilling winds of unforeseen medical expenses. This narrative takes a poignant turn in the tale of an average family, where the primary earner’s illness can unravel the fabric of their financial stability, often leading to a downward spiral of debt and despair.

Within this narrative, GOQii stands as a beacon, guiding a transformation from reactive to proactive healthcare. The company’s innovative model fuses health insurance with the active pursuit of wellness, emphasising the primacy of preventive health. This strategy, deeply rooted in the philosophy of personalized medicine, recognizes the unique health signatures of individuals, tailoring health interventions to their specific genetic, environmental, and lifestyle factors. It’s a model that promises not just to treat but to forestall, pushing the boundaries of longevity.

Longevity is about extending the vitality and health span of individuals, not just adding years to life. By proactively addressing wellness and health risks before they manifest, GOQii aims to enhance the quality and duration of life, ensuring that each year is lived to the fullest

At the forefront of GOQii’s approach is the artful integration of gamification. This element transforms the journey of health into an engaging, rewarding odyssey. Each step, each choice for a healthier lifestyle, is not just a move towards longevity but also a play in a larger game of wellness. Users are motivated by points, rewards, and recognition, making the pursuit of health a fulfilling and enjoyable experience.

GOQii is not just offering a lifeline; it’s promoting a lifestyle. They have ingeniously woven health insurance with an active pursuit of wellness, creating a synergy that underscores their credo: healthy living is a reward in itself. It is not just about mitigating risks but about transforming lives. The subscribers of GOQii are drawn into a dynamic ecosystem where their steps towards health are measured, monitored, and, most importantly, rewarded.

GOQii’s insurance cover reflects this innovative ethos and pivots on the user’s engagement in their health. The more actively users participate in managing their health through fitness routines and regular check-ups, the more they benefit. This model fosters a win-win situation: lower premiums for healthier lifestyles and enhanced health benefits, leading to a decrease in the incidence of chronic diseases and a corresponding reduction in healthcare costs.

At the heart of this narrative lies a profound belief: that the future of healthcare is not just in treating illness but in celebrating health. GOQii’s platform is a testament to this belief, designed to inspire, engage, and reward. It’s a platform that embraces the joy of living a healthy life, supporting users in their journey towards not just surviving, but thriving.

GOQii is reimagining the landscape of health insurance and healthcare in India. It’s a vision that transcends the traditional confines of healthcare, embedding the ethos of preventive health, personalized medicine, and the joys of gamification into the very fabric of life. As this vision unfolds, it heralds a new era where good health is not just a prudent choice but a deeply rewarding and personal journey towards longevity and wellness.

#BeTheForce

To activate your GOQii Insure+ plan of Health insurance and Life insurance covers, all you need to do is activate your GOQii Personal Care subscription. Every GOQii player (user) that activates their Insure+ plan starts their health journey on the lowest tier of the S.A.F.E score i.e. Sedentary. At this level, you are eligible for a Health Insurance cover of ₹1 Lakh & a Life Insurance cover of ₹1 Lakh.

To activate your GOQii Insure+ plan of Health insurance and Life insurance covers, all you need to do is activate your GOQii Personal Care subscription. Every GOQii player (user) that activates their Insure+ plan starts their health journey on the lowest tier of the S.A.F.E score i.e. Sedentary. At this level, you are eligible for a Health Insurance cover of ₹1 Lakh & a Life Insurance cover of ₹1 Lakh. One of the key points mentioned during GOQii’s annual event in December last year was that our current healthcare systems focus more on ‘sick care’ rather than preventive healthcare. Measures taken to ensure good health are often reactive as compared to proactive. The problem with this approach is that any precautions we take concerning health won’t be in place until it is too late.

One of the key points mentioned during GOQii’s annual event in December last year was that our current healthcare systems focus more on ‘sick care’ rather than preventive healthcare. Measures taken to ensure good health are often reactive as compared to proactive. The problem with this approach is that any precautions we take concerning health won’t be in place until it is too late.

Insurance premiums are on a constant rise, it is getting more expensive year after year and procuring ideal health insurance for you and your family has become shockingly confusing. What exactly is “Ideal” when we talk about Health Insurance?

Insurance premiums are on a constant rise, it is getting more expensive year after year and procuring ideal health insurance for you and your family has become shockingly confusing. What exactly is “Ideal” when we talk about Health Insurance?