In my previous article, I spoke about breathing through the nose. In this article, let me take it a bit deeper and speak about abdominal breathing. It is observed that many of us breathe through our chest and our breathing is therefore shallow.

This issue compounds when you are awake, in the office, working on something important, tense, or under stress and hyperventilate. Shallow breathing compounded with hyperventilation leads to SUBOPTIMAL gas exchange.

We take so much care about nutrition and food, but we need to know how to burn it. Same as filling Premium Petrol, as well as knowing optimal driving techniques! Unburnt or sub-optimally burnt food is responsible for weight gain, diabetes and so many chronic lifestyle illnesses.

The goal of good nutrition is that it is absorbed well and burnt well. So, right breathing is equally, if not more, important than eating the right food.

Take this simple test to know how you breathe

- Lie on your back with your knees bent

- Place one hand or a small book on your chest and the other on your stomach.

- Breathe normally, observe what is rising – the chest or the abdomen

Observe which is rising up and down. If it is your chest, you are shallow breathing and if it is the abdomen more than the chest, you may be closer to what is the right breathing.

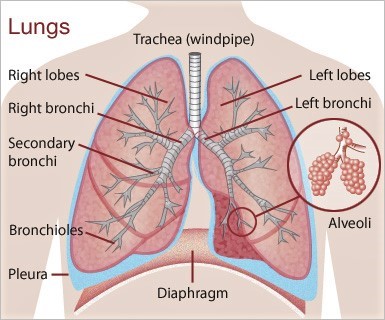

See the picture below to understand why this is important

Lungs are narrow at the top and wide at the bottom – sort of “Inverted V” shape. The blood flow at the bottom of the lungs is approx. 10 times than the top.

Most of the bunch of grapes (alveoli) which are the instruments of gas exchange (topic to be explained later) is at the bottom of the lungs. Now, if you breathe through your chest, you are leaving more than 60% of your lung’s “installed capacity” unused.

CFOs will know that unused installed capacity is costly! Diaphragmatic breathing gives you High Return on Inhaled Air (investment)! Simple. You can observe animals breathing, for example observe a Cow – they breathe through the abdomen only. Somewhere in evolution, the modern human has forgotten the art of breathing.

The Additional Advantages Of Abdominal Breathing

- Abdomen movement helps the movement of lymphatic fluids – unlike the blood, there is no pump for lymphatic fluids. Only muscular movement acts as a pump

- Abdomen movement also continuously massages the parts of stomach like liver and intestine

- Abdominal movement makes it easy and lighter for your heart to pump blood

Shallow breathing leaves air behind in the lower parts of the lung, making it vulnerable to easy infection. So, why don’t we use the abdomen for breathing and benefit from optimal gas exchange which in turn helps in supplying efficient fuel (oxygen) to burn the food you are eating?

If you want to make diaphragmatic breathing into a habit, you can follow Conscious Breathing classes by Anders Olsson or Wim Hof method (which I follow) or from any Yoga Guru.

We hope this article on abdominal breathing helps you. Do leave your thoughts in the comments below. For more on breathing, check out Healthy Reads or get these tips directly from your GOQii Coach by subscribing to personalized coaching here: https://goqiiapp.page.link/bsr

Breathe Right & #BeTheForce

We take our immune systems for granted at most times. With the heightened threat of COVID-19 infection that is something, we can no longer afford to do. Boosting your immunity doesn’t require drastic action however. By digging into our rich Ayurvedic traditions we can find plenty of helpful information. In fact, Ayurveda’s primary focus has always been on disease prevention, rather than treatment. This means that it contains a vast repository of knowledge on strategies to strengthen and support natural functions, including immunity.

We take our immune systems for granted at most times. With the heightened threat of COVID-19 infection that is something, we can no longer afford to do. Boosting your immunity doesn’t require drastic action however. By digging into our rich Ayurvedic traditions we can find plenty of helpful information. In fact, Ayurveda’s primary focus has always been on disease prevention, rather than treatment. This means that it contains a vast repository of knowledge on strategies to strengthen and support natural functions, including immunity.

As you grow older, physical changes and health conditions, as well as the medications used to treat those health conditions, can lead to falls in older adults. So, it’s very important to make sure that the older adults at home are safe. If you’re an older adult or have someone older who stays with you, here are a few things you can do to ensure their safety and prevent falls.

As you grow older, physical changes and health conditions, as well as the medications used to treat those health conditions, can lead to falls in older adults. So, it’s very important to make sure that the older adults at home are safe. If you’re an older adult or have someone older who stays with you, here are a few things you can do to ensure their safety and prevent falls.